Calendar Spread Options – The long put calendar spread is a strategy designed to profit from a near-total coma in the underlying shares. Employing two different put options spread across two calendar months — with a . Multiplied by 100 shares per contract, you’ve spent $52 to enter the calendar spread. In the best-case scenario, Stock XYZ will be trading squarely at the strike price of your call options when .

Calendar Spread Options

Source : www.investopedia.com

Calendar Spread Definition: Day Trading Terminology Warrior Trading

Source : www.warriortrading.com

How to Trade Options Calendar Spreads: (Visuals and Examples)

Source : www.projectfinance.com

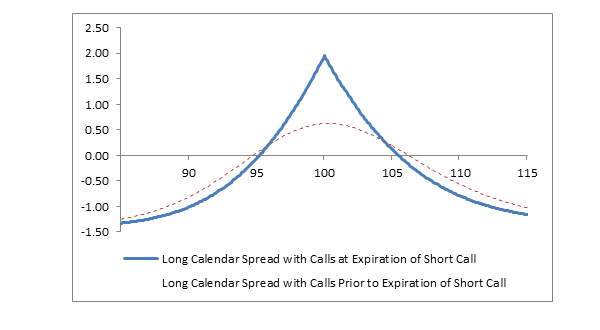

Long Calendar Spread with Calls Fidelity

Source : www.fidelity.com

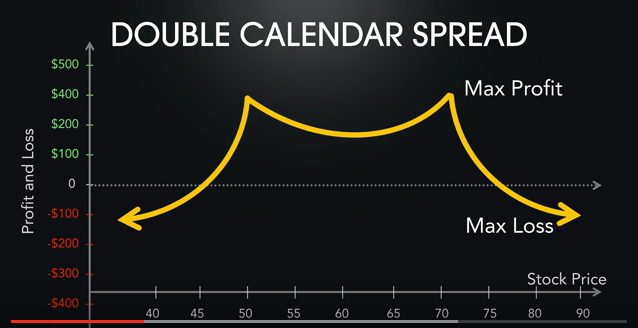

The Double Calendar Spread

Source : www.options-trading-mastery.com

Calendar Spread: What is a Calendar Spread Option? | tastylive

Source : www.tastylive.com

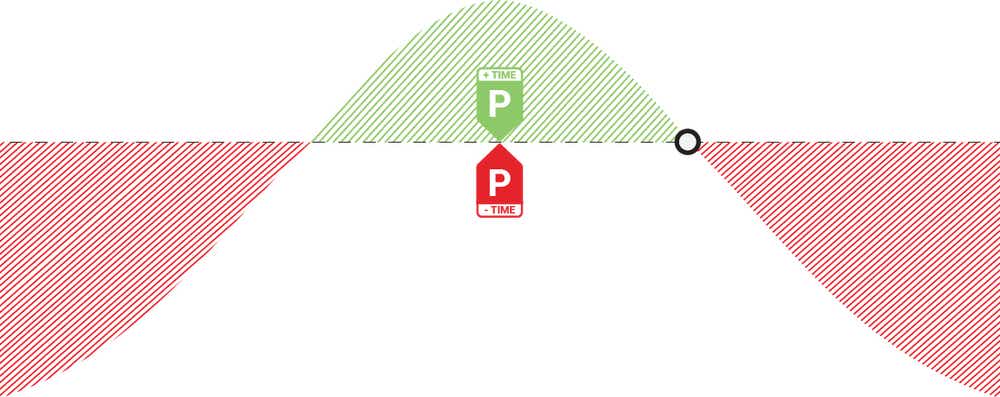

options Understanding the visual representation of a Calendar

Source : money.stackexchange.com

Calendar Spread Options Trading Strategy In Python

Source : blog.quantinsti.com

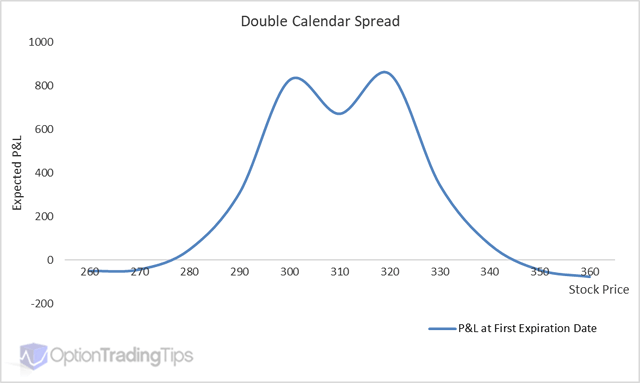

Double Calendar Option Spread

Source : www.optiontradingtips.com

Calendar spread options strategy | Fidelity

Source : www.fidelity.com

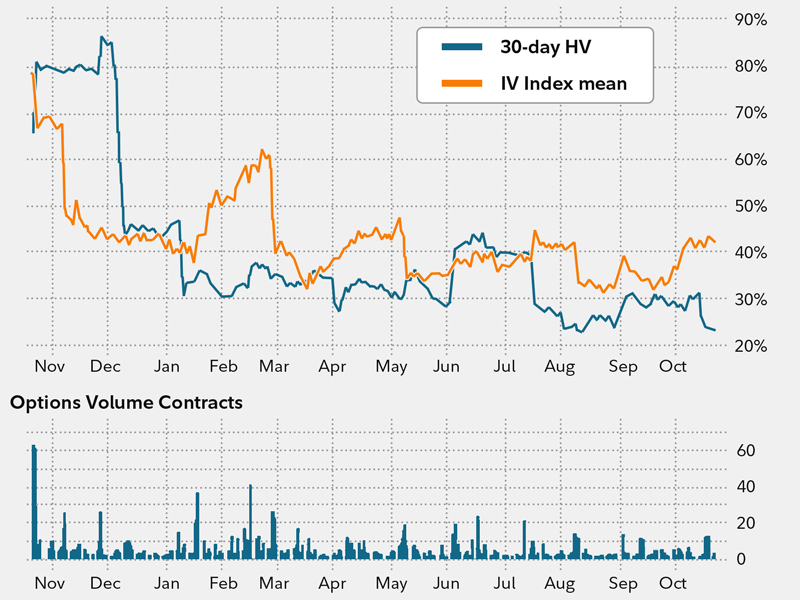

Calendar Spread Options Calendar Spreads in Futures and Options Trading Explained: With Alphabet stock trading at $170, setting up a calendar spread at $175 gives the trade a neutral to slightly bullish outlook. Selling the May 31 call option with a strike price of $175 and . Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)